knoxville tn state sales tax rate

The state sales tax rate in Tennessee is 7000. 925 7 state 225 local City Property Tax Rate.

Which Tennessee Counties Might See The Largest Drop In Sales Tax Revenue

Estimated Combined Tax Rate 925 Estimated County Tax Rate 225 Estimated City Tax Rate 000 Estimated Special Tax Rate 000 and Vendor Discount None.

. RE trans fee on median home over 13 yrs Auto sales taxes amortized over 6 years Annual Vehicle Property Taxes on 25K Car. The minimum combined 2022 sales tax rate for Knoxville Tennessee is. Counties and cities can charge an additional local sales tax of up to 275 for a maximum possible combined sales tax of 975.

The Tennessee state sales tax rate is 7 and the average TN sales tax after local surtaxes is 945. The general state tax rate is 7. Depending on local tax jurisdictions the total sales tax rate can be as high as 10.

Tennessee has 779 special sales tax jurisdictions with local sales taxes in addition to the state sales tax. City of Knoxville Revenue Office. For County tax information contact Knox County Trustee at 865-215-2305 or httpspropertytaxknoxcountytngov.

With local taxes the. Average Sales Tax With Local. You may also be interested in estate sale companies in Knoxville.

212 per 100 assessed value. Questions regarding information provided here can be answered by calling 865-215-2084 or email at citytaxofficeknoxvilletngov. The Clerk and Master will open the bidding process with the total due on the property for delinquent taxes through the 2012 tax year interest penalty fees and other cost associated with the sale owed to the City of Knoxville Tennessee and Knox County Tennessee.

The sales tax is Tennessees principal source of state tax revenue accounting for approximately 60 of all tax collections. 4 State Sales tax is 700. The Knoxville sales tax rate is.

24638 per 100 assessed value. Local collection fee is 1 Fees. This website provides tax information for the City of Knoxville ONLY.

There are some exceptions but generally each time there is a transfer of title to a motor vehicle the transaction is subject to sales or use tax. The Tennessee sales tax rate is currently. 31 rows The state sales tax rate in Tennessee is 7000.

Estimated Combined Tax Rate 925 Estimated County Tax Rate 225 Estimated City Tax Rate 000 Estimated Special Tax Rate 000 and Vendor Discount None. Show Sales Within 15 Days. County Property Tax Rate.

Knoxville is a city in and the county seat of Knox County in the US. Get rates tables What is the sales tax rate in Knoxville Tennessee. Knoxville TN Estate Sales around 37919.

Sales Tax and Use Tax Rate of Zip Code 37922 is located in Knoxville City Loudon County Tennessee State. This amount is never to exceed 3600. Under Tennessee sales and use tax law sales of motor vehicles trailers and off-highway vehicles are sales of tangible personal property subject to sales or use tax.

The local tax rate may not be higher than 275 and must be a multiple of 25. Sales Tax and Use Tax Rate of Zip Code 37932 is located in Knoxville City Knox County Tennessee State. 1 State Sales tax is 700.

The local tax rate varies by county andor city. The County sales tax rate is. Ad Find Out Sales Tax Rates For Free.

Fast Easy Tax Solutions. Business Tax Guide The Department of Revenue also offers a telecommunications device for the deaf TDD line at 615 741-7398. 17 Results Listed below are all the estate sales that are currently scheduled for the Knoxville area.

Real property tax on median home. 3 rows The 925 sales tax rate in Knoxville consists of 7 Tennessee state sales tax and. Tennessee has state.

Local Sales Tax is 225 of the first 1600. This is the total of state county and city sales tax rates. Did South Dakota v.

The sales tax is comprised of two parts a state portion and a local portion. Sort By Date Then Time Distance Only Date Then Distance Newly Listed. A bill to help pay for a 65 million multi-use stadium in downtown Knoxville is heading to the governors desk after it was passed in the Tennessee House and Senate.

4 rows Knoxville TN Sales Tax Rate The current total local sales tax rate in Knoxville TN is. Current Sales Tax Rate. State Sales Tax is 7 of purchase price less total value of trade in.

Other local-level tax rates in the state of Tennessee are quite complex compared against local-level tax rates in other states. The Tennessee TN state sales tax rate is 70. Sales Tax State Local Sales Tax on Food.

For purchases in excess of 1600 an additional state tax of 275 is added up to a maximum of 44.

Tennessee Sales Tax And Other Fees Motor Vehicle County Clerk Knox County Tennessee Government

Tennessee Car Sales Tax Everything You Need To Know

Which Tennessee Counties Might See The Largest Drop In Sales Tax Revenue

Tennessee Sales Tax Rates By City County 2022

Which Tennessee Counties Might See The Largest Drop In Sales Tax Revenue

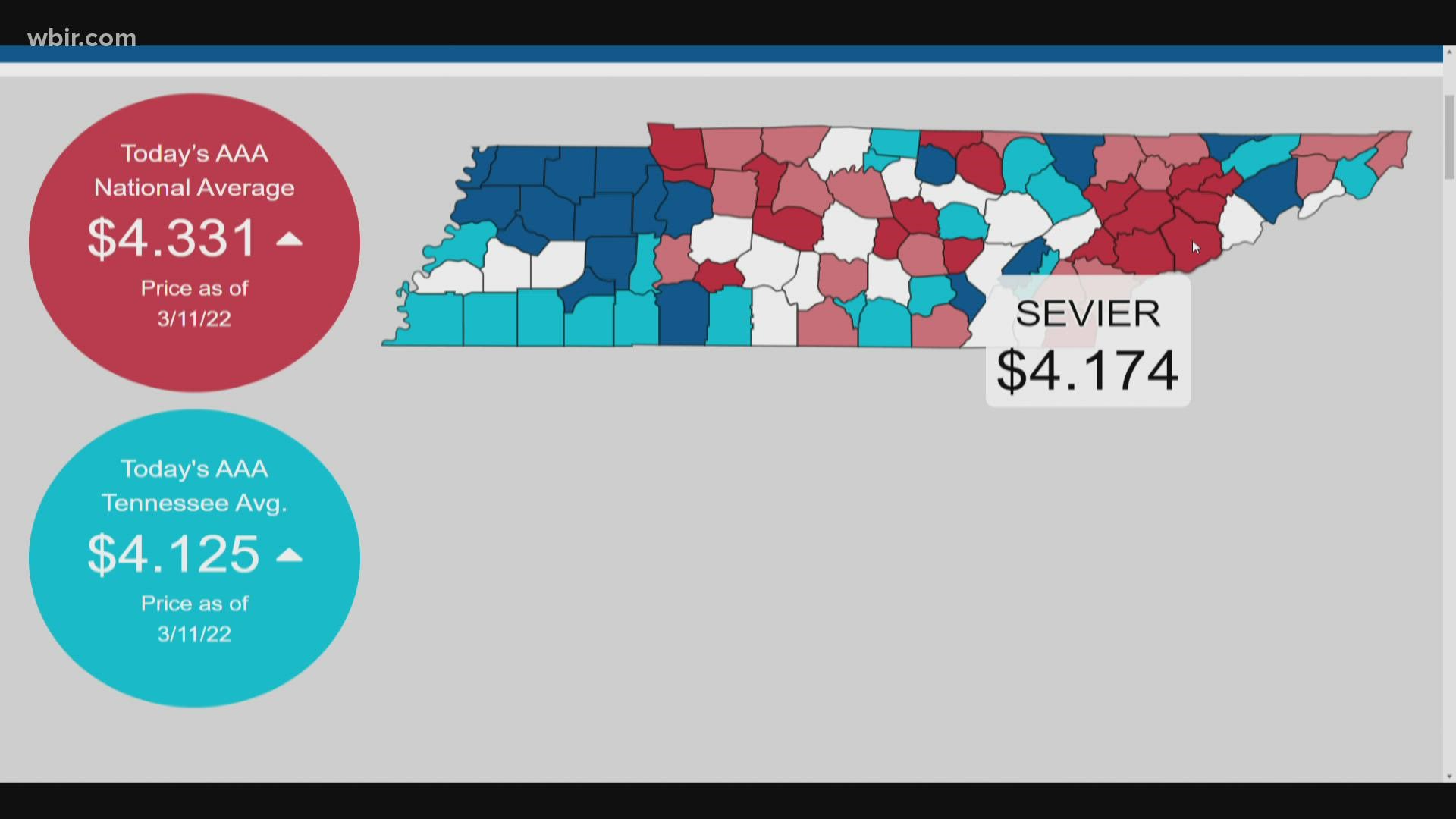

Gov Lee Has No Plans To Halt Tn S Gas Tax Amid Price Surge Wbir Com

Tennessee Income Tax Calculator Smartasset

The Ultimate Guide To Tennessee Real Estate Taxes

Moving To Knoxville Tennessee The Truth About Living Here

Taxes Powerpoint Notes Part 3 Sales Tax This Is The Tax Added Onto The Price Of Goods And Services Tennessee Has A State Sales Tax The State Ppt Download

Which Tennessee Counties Might See The Largest Drop In Sales Tax Revenue

Knoxville Real Estate Market Trends And Forecasts 2020

Tennessee Sales Tax Small Business Guide Truic

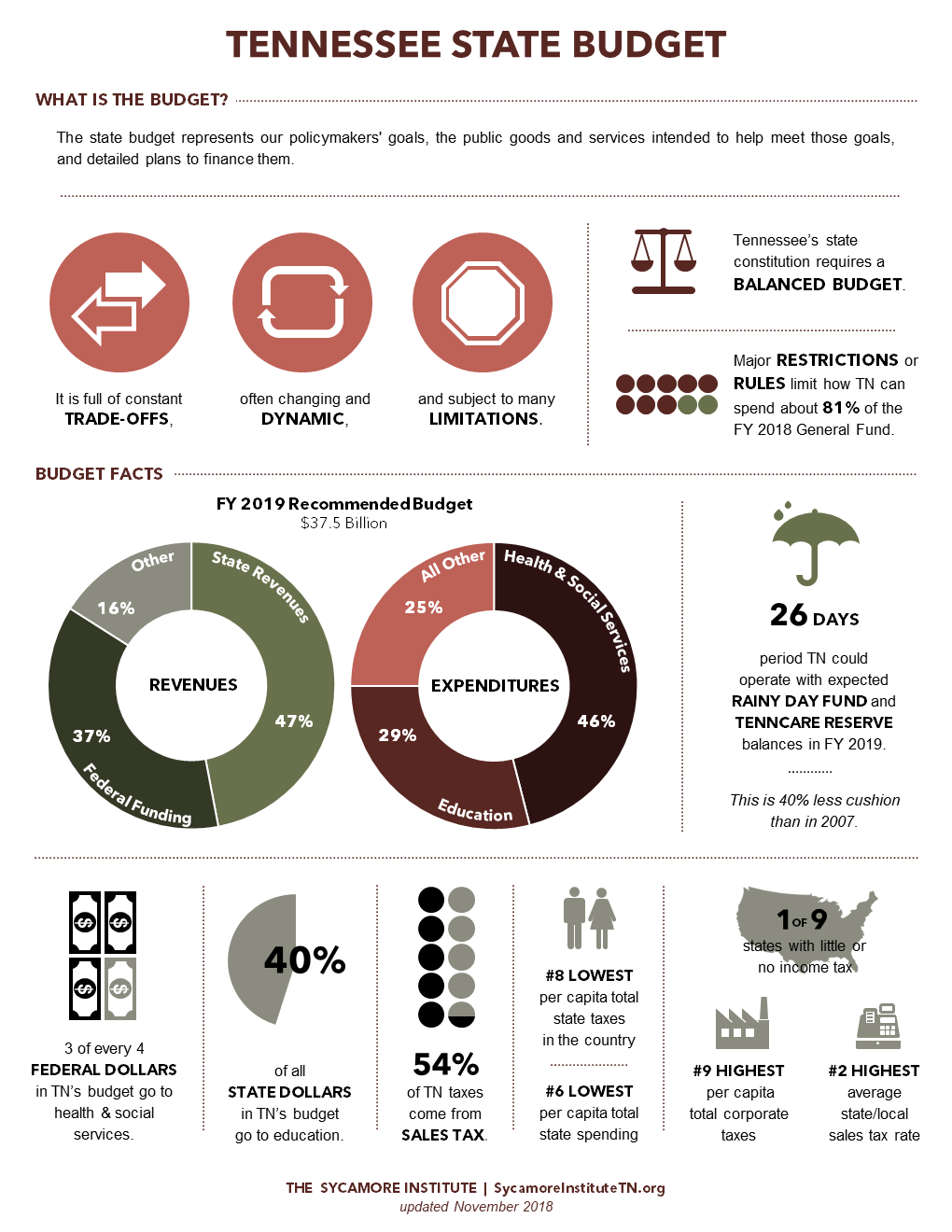

Tennessee Budget Primer The Sycamore Institute

Which Tennessee Counties Might See The Largest Drop In Sales Tax Revenue

Airbnb Will Start Collecting Lodging Tax In Knoxville Tennessee

Which Tennessee Counties Might See The Largest Drop In Sales Tax Revenue